Every retirement plan is unique and asks the age old question: How much do I need to retire? It takes a lot of finesse to devise each individual’s “magic” retirement age and dollar amount. The industry’s rule of thumb is to draw down 4% of one’s assets in a 60/40 portfolio, which often leads to the best probability of sustaining a 30yr retirement. Personally, I hate using that “rule;” the answer is far from that simple. When trying to ascertain your personalized retirement age, here are some items to consider.

Work Backwards

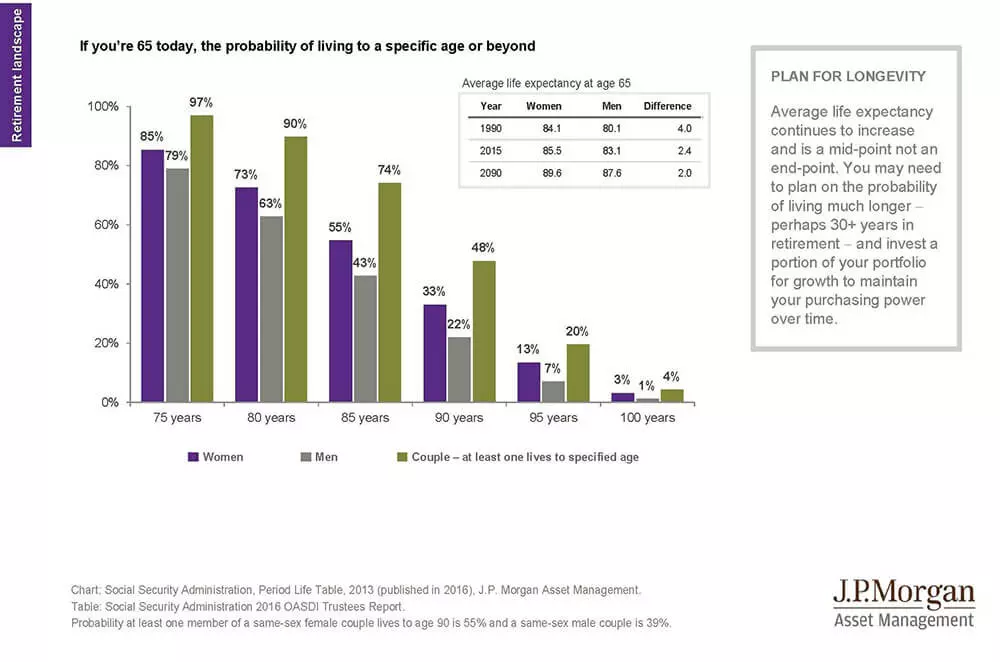

You can’t determine what you need if you don’t know how much you should anticipate retirement to cost. Start by figuring out the type of retirement you want. If you are like most, you want to maintain your current lifestyle. With that assumption, do you really have a good sense of your expenses? Most people’s estimates are off by 10–20%. If you’re planning a long retirement and are under by 10%-20%, it will make a significant difference. If you don’t keep good records, I suggest looking at your current after-tax paycheck. Then, add back health insurance costs and subtract any additional after-tax savings. This should reveal your estimated monthly costs. Additionally, you must account for large expenses and make a loose assumption on life expectancy. (I recommend spending 5 minutes on livingto100.com to get a rough sense of your life expectancy.) With the constant increase in modern medicine, I always recommend adding a few extra years to the end of your assumption. Below is a great visual:

Inflation

Once you understand your expenses, you’ll need to get a sense of the inflation rate at retirement. I tend to use 3% for inflation as it’s close to historical rates. Today, however, we are in a low inflation environment of approx 2%, which happens to be the Federal Reserve target. Another quick tip: grow your health care expenses by a higher rate of return, say 5%. Legacy What is the amount of money or legacy you want to leave behind? I’ve heard everything from “I want my last check to bounce” to “I’d like to leave each kid $1,000,000.” Think through this carefully. If you don’t, it will be determined for you.

Retirement Income

How will you fund retirement? It’s critical to get a sense of what will be funded from fixed income. I assume you and your spouse will receive Social Security. That said, estimate minimal to no growth on these figures. Therefore, what other type of incomes will you have? (Pensions? Annuities? Part time work?) Whatever it might be, it’s important to get a clear sense of how much these fixed incomes will be and when you’ll receive those dollars.

Taxes

Understanding how your current assets are held helps you understand the tax implications. Broken down to four categories (IRA’s, Roth IRA’s, cash, and Non-Retirement investment accounts), presume the tax treatment is as follows:

- Traditional IRA/401(k)– taxed as if it is all ordinary income.

- Roth IRA – no taxes owed when taking withdrawals.

- Cash – no taxes owed when taking withdrawals.

- Non-Retirement Investment Accounts – growth taxed at long term capital gain rate (15% if married and under $250,000 of AGI).

Stay away from guessing the future tax rates and just use the current ones. Here is a link from the Diversified website to understand 2017 rates: Tax Rates 2017.

Investment Mix & Returns

The final piece is your risk tolerance and investment mix. Think of these things as return over your inflation rate. This is very important. Cash earns 0% and inflation of 3% actually looses purchasing power value. I like to reverse solve this as well. Understand the amount you want in “safer” assets, along with the “riskier” assets. It’s important to find that specific comfort zone for you. Emotions are the number one detractor from achieving your desired investment returns, so stick to the plan. I’d assign a 6-8% growth rate to stocks, 3-5% growth rate to bonds, and 0% growth rate to cash.

My Magic Number!

Hopefully, you now have a sense for: what it costs to be you; how long you (approx) expect to live; how your costs will grow; what legacy you want to leave behind; what income to be expected in your retirement; and what taxes are owed on redeeming your assets. With this information, you can assign amounts to everything. It will help you solve for what your “magic” number truly will be. You only get one shot at retirement; make it a great one!

Author

In his role as Financial Planner, Andrew forges lifelong relationships with clients. He coaches them through all stages of life and guides them to better achieve their life goals. To set up an appointment with Andrew, or any of our qualified financial advisors, contact us at clientservices@diversifiedllc.com or call 302-765-3500.

Financial planning and Investment advisory services offered through Diversified, LLC. Diversified is a registered investment adviser, and the registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the SEC. A copy of Diversified’s current written disclosure brochure which discusses, among other things, the firm’s business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. Diversified, LLC does not provide tax advice and should not be relied upon for purposes of filing taxes, estimating tax liabilities or avoiding any tax or penalty imposed by law. The information provided by Diversified, LLC should not be a substitute for consulting a qualified tax advisor, accountant, or other professional concerning the application of tax law or an individual tax situation. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.