Equities Slip on Earnings Reports and Housing Data

Equities Slip on Earnings Reports and Housing Data

Equity markets fell slightly on a relatively calm week as investors assessed earnings reports and housing data. Global equities (represented by the MSCI All Country World Index) were down -0.29%, and domestic stocks (represented by the S&P 500 Index) were down -0.09%.

Housing Data

US housing data released last week showed a slowing within the housing market as the space feels the effects of the Fed’s tightening policy and elevated mortgage rates. The median existing home sale price fell -0.9% on a year-over year basis in March, the largest decline in 11 years. Additionally, existing home sales dropped on a monthly basis in March by -2.42%.

Earnings

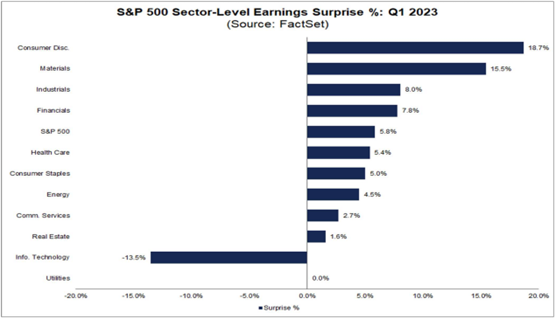

With about 18% of S&P 500 companies reporting first-quarter earnings, 76% of companies have beat analyst expectations on EPS versus the 77% five-year average according to FactSet. Although revenue growth continues to be positive for many companies, commentary and guidance has been lackluster with concerns including pending recession. According to FactSet, analysts are expecting an overall decline in S&P 500 company earnings which would mark the second consecutive quarter of negative earnings growth.

Unemployment

US initial weekly claims for unemployment ticked up slightly last week to 245,000. However, continuing claims rose more than expected to 1.87 million, the highest number since 2021. While the labor market has been largely resilient, investors continue to monitor data which may change the Fed’s direction on rates.

GDP

This week US first quarter GDP initial estimates are released. Fourth quarter GDP rose by 2.6%, and economists are expecting a slight slowdown for the first quarter at an annual rate of 2.0%. Another inflation report in the US Personal Consumption Expenditures (PCE) Price Index will be released this week as well. In February, the year-over-year PCE index rose 5.0%, down from its peak in June of 6.98%.

I’d like to leave you with the final line we’ve used since we started these commentaries back at the very height of market volatility in March 2020. Always remember that we create financial/investment plans not for the easy times, but to prepare for the tough ones.