Equity Markets End Q3 Lower

Equity Markets End Q3 Lower

Equities ended the third quarter of the year down for the sixth time in seven weeks. Global equities (represented by the MSCI All Country World Index) were down -2.48%, and domestic stocks (represented by the S&P 500 Index) were down -2.88%.

Personal Consumption Expenditures

The monthly US Personal Consumption Expenditures price index showed higher than expected inflation for August. August’s monthly core reading showed prices rise 4.9% on a year-over-year basis while the previous month’s reading was 4.7%.

Eurozone Inflation

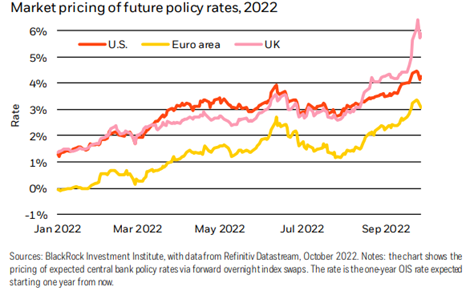

The Eurozone’s key inflation gauge rose 10.0% for September on an annual basis with energy costs being a continued headwind. Germany reported consumer prices rose by 10.9%, showing heavy inflation remains a global issue that central banks will continue to tackle. The below image shows where policy rates are expected to go. The UK’s initial plan of tax cuts and spending increases in order to boost growth caused more weakness for the currency and raised rate expectations. The Finance Minister, Kwasi Kwarteng, confirmed Monday that they would be scrapping the tax cuts on the higher earners in response.

Treasury Yields

Yields continue to remain volatile as markets price in further central bank interest rate hikes. The US 10-year treasury yield reached 3.99% last week, the highest level in 14 years, while ending the week around 3.80%.

Mortgage Rates

Mortgage rates continue to rise as the average 30-year mortgage rate currently sits around 6.70% according to Freddie Mac. The rate entered the year at an average of 3.22%. Even with higher mortgage rates, housing sector data remains mixed. New US home sales rose nearly 29% in August while pending sales and home prices fell slightly.

What’s Next?

This week we look forward to data releases on manufacturing and services sectors as well as the September jobs report. Weekly jobless claims fell to their lowest level since April last week, so the jobs report this week will provide a clearer image of the strength of the labor market. Last month’s report showed that the unemployment rate rose slightly from 3.5% to 3.7%.

I’d like to leave you with the final line we’ve used since we started these commentaries back at the very height of market volatility in March 2020. Always remember that we create financial/investment plans not for the easy times, but to prepare for the tough ones.