A Hawkish Fed and Shopping Slowdown Send Stocks Lower

A Hawkish Fed and Shopping Slowdown Send Stocks Lower

Equity markets fell last week as investors digested the release of CPI, US retail sales, and the Fed’s latest rate decision. Global equities (represented by the MSCI All Country World Index) were down -2.11%, and domestic stocks (represented by the S&P 500 Index) were down -2.05%.

Inflation News

The US Consumer Price Index released Tuesday morning started the week on a more positive note as the data seemed to show a continued easing of inflation. CPI rose a modest 0.1% in November and 7.1% on an annual basis which is the lowest annual level since last December. Core inflation (excluding food and energy) rose 0.2% month-over-month which was slightly below expectations.

FOMC Meeting

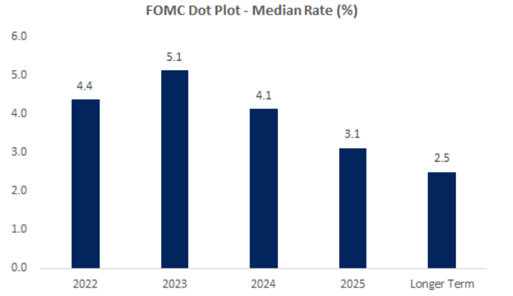

The December FOMC meeting concluded with a 0.50% rate increase which was widely expected. However, Fed Chair Powell’s speech and the Fed’s dot plot projections for the fed funds rate fueled a sell-off in equities as Fed Chair Powell reiterated that more rate hikes are likely to come and the dot plot indicating a median rate of 5.1% in 2023, higher than the 4.6% anticipated by officials from September and recent consensus estimates of 4.8-5.0%.

Retail Sales

US retail sales for November fell 0.6% from the previous month, turning course from October’s 1.3% growth. The release indicates a disappointing Black Friday and Cyber Monday shopping season and a potential signal of curbed consumer demand.

Key Rate Raises

The US Fed was not alone in raising their key rate as the Bank of England and the European Central Bank also raised their target rates by 0.50% last week. A similar message echoed across all their commentary that more rate hikes are likely in order to tame inflation back closer to targets.

PCE Price Index

This week another price check is in store as the Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, will be updated. The last report showed core PCE inflation rising 5.0% on an annual basis in October, falling from the prior month’s 5.2% reading.

I’d like to leave you with the final line we’ve used since we started these commentaries back at the very height of market volatility in March 2020. Always remember that we create financial/investment plans not for the easy times, but to prepare for the tough ones.