Equities Rise on Moderating Inflationary Data

Equities Rise on Moderating Inflationary Data

Global equities rose for the fourth straight week. Global markets (represented by the MSCI All Country World Index) were up 2.90% and domestic stocks (represented by the S&P 500 Index) were up 3.31%.

Inflation and the CPI

Markets welcomed last week’s reports on inflation for the month of July which showed easing consumer and producer prices. The Consumer Price Index recorded an annual increase of 8.5% for July which marked a relief from the previous month’s reading of 9.1%. US producer prices also had a positive surprise with prices declining 0.5% month-over-month.

Consumer Sentiment

US consumer sentiment has risen while market volatility has dropped over the past weeks. The University of Michigan’s US Index of Consumer Sentiment has risen two months in a row after recording its lowest level dating back to 1952 in June. The report showed slight relief to consumers’ inflation expectations for the future but still remained elevated. The CBOE Volatility Index (VIX) has declined for the 8th week in a row, now down nearly 45% from the peak this year. Inflation and the Fed’s future decisions on interest rates remain top of mind for investors.

S&P

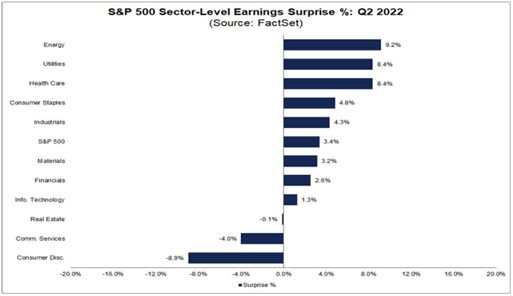

All S&P 500 sectors posted positive returns last week. Energy was up 7.1%, the highest of all sectors, with many companies posting strong earnings. According to FactSet, the energy sector is reporting a year-over-year earnings growth of 299%, the highest of all sectors. Positive earnings surprises have helped dampen market volatility and provide markets relief from their year-to-date lows.

I’d like to leave you with the final line we’ve used since we started these commentaries back at the very height of market volatility in March 2020. Always remember that we create financial/investment plans not for the easy times, but to prepare for the tough ones.