Geopolitics Drive Choppy Markets

Geopolitics Drive Choppy Markets

With Russia’s invasion of Ukraine, markets were very choppy last week. We saw global markets (represented by the MSCI All Country World Index) down -0.6% and domestic stocks (represented by the S&P 500 Index) up 0.8%.

Commodities

For those of you who read our brief commentary on the situation last week, you know that the primary economic area where this conflict will have an impact is in commodities. Coming at a time when inflation is a global issue, the conflict will impact several areas where the countries are leading exporters. For example, both Ukraine and Russia are large grain exporters. Additionally, Russia supplies a sizable amount of global energy along with aluminum, titanium, and other metals. We will need to keep an eye on whether this changes the Fed’s outlook on interest rates.

Oil

Keeping an eye on oil prices, most recently WTI crude oil sits at $95 per barrel.

Labor

With the month of February ending today, we’ll get a fresh labor market report this coming Friday. As of January, the unemployment rate here in the U.S. sat at a strong 4.0%.

Inflation

A recent gauge of inflation, the core personal consumption expenditures price index, was up 5.2% year-over-year through January. That figure is important given that the Fed prefers that index when measuring inflation.

Stock Market Corrections

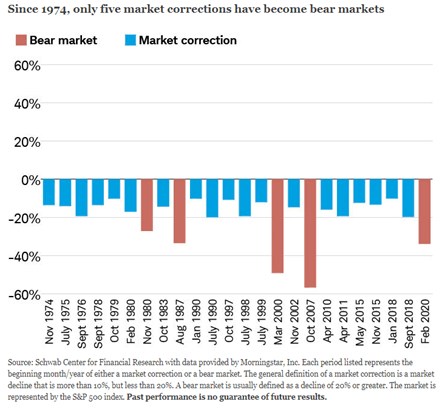

Reiterating what we communicated last week, stock market corrections happen. Unfortunately, financial news and headlines prefer to make it sound like this time is different and worse, but it is important to remain calm and keep perspective. This is a major geopolitical event with real ramifications in certain regions and industries. Historically, this type of event causes a short-term bout of volatility and then markets begin to recover as they assess the economic impact.

Below is a chart showing all the domestic market corrections since the mid-1970s, and you’ll likely be surprised by how many have taken place. In our opinion, the key is controlling your behavior, remaining disciplined, and understanding the true impact on the portfolio you own. One common trait for each of the below events is that they all recovered, although some quicker than others. We advocate for remaining patient, proactive, and reaching out to us if you have any questions or concerns that we can help with.

I’d like to leave you with the final line we’ve used since we started these commentaries back at the very height of market volatility in March 2020. Always remember that we create financial/investment plans not for the easy times, but to prepare for the tough ones.