Another Choppy Week Headlined by Retailer Earnings

Choppy Week Headlined by Retailer Earnings

U.S. markets fell while the international market rose in another volatile week in stock markets. We saw global markets (represented by the MSCI All Country World Index) down -1.1% and domestic stocks (represented by the S&P 500 Index) down -3.0%.

Retailer Earnings and Inflation

Over the long term, the performance of the stock market is primarily driven by the underlying earnings of its constituents. Right now, markets are trying to come to grips with what the earnings outlook is for companies, as supply chains and inflation put pressure on bottom-line earnings moving forward. Much of the volatility last week was in response to the earnings of Target and Walmart, where management stated that consumers have shifted in what they’re purchasing. Despite these changes and pressures, management did emphasize that consumer traffic remained very strong and that they expect supply chain issues to relax as the year progresses.

As market volatility has picked up and prices fell, valuations have become much more attractive for investors, According to FactSet, the forward price/earnings ratio for the S&P 500 is at 16.4. That is below the average for both the last 5 years and 10 years. In short, that just means that the price you pay per unit of earnings is much more attractive than 6 months ago.

China and Covid

As it continues its zero-COVID policy, China’s economy has come under pressure from very harsh lockdown conditions. In response, the central bank of China lowered one of its key interest rates to help stimulate economic growth. While most of the developed world kept rates very low throughout the pandemic, China was one of the earliest to begin raising rates, which gives them some flexibility today.

Retail Sales

During last week, it was released that retail sales rose 0.9% over the previous month, which is the fourth straight monthly increase.

Economic News

There are two major economic releases this week. First, the minutes from the early-May Federal Reserve meeting will be released, which should give some greater insight into the conversations that were had. Additionally, on Friday, the Fed’s preferred inflation gauge, the Personal Consumption Expenditures index, will be released.

Reactions to the Market

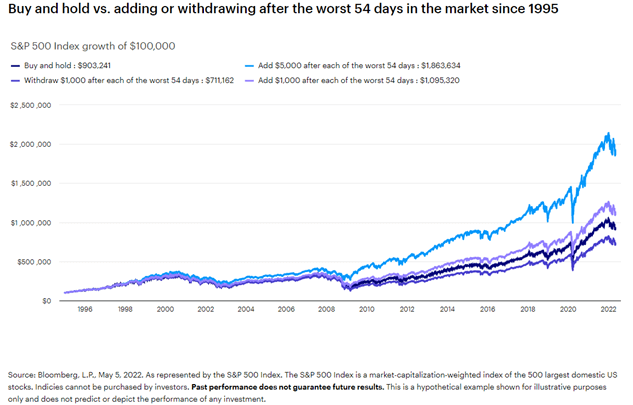

I thought the below graphic was a great one. It illustrates the difference among investors in the domestic stock market from 1995 until earlier this year depending on how they reacted to the worst market days.

I’d like to leave you with the final line we’ve used since we started these commentaries back at the very height of market volatility in March 2020. Always remember that we create financial/investment plans not for the easy times, but to prepare for the tough ones.

S&P 500: The Standard & Poor’s 500 Composite Stock Price Index is a capitalization-weighted index of 500 stocks intended to be a representative sample of leading companies in leading industries within the U.S. economy. Stocks in the Index are chosen for market size, liquidity, and industry group representation.

Russell 2000: The Russell 2000® Index is a capitalization-weighted index designed to measure the performance of the 2,000 smallest publicly traded U.S. companies based on in market capitalization. The Index is a subset of the larger Russell 3000® Index.

MSCI All Country World Index: The MSCI ACWI captures large and mid-cap representation across 23 Developed Markets (DM) and 24 Emerging Markets

(EM) countries. With 2,937 constituents, the index covers approximately 85% of the global investable equity opportunity set.

GDP: Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

The views expressed in this commentary are subject to change and are not intended to be a recommendation or investment advice. Such views do not take into account the individual financial circumstances or objectives of any investor that receives them.

All indices are unmanaged and are not available for direct investment. Indices do not incur costs including the payment of transaction costs, fees and other expenses. This information should not be considered a solicitation or an offer to provide any service in any jurisdiction where it would be unlawful to do so under the laws of that jurisdiction. Past performance is no guarantee of future results.

Financial planning and Investment advisory services offered through Diversified, LLC. Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Diversified, LLC are not affiliated companies.