Wealth Management

Our investment committee handles the investing, while your dedicated financial planner does the planning

– so you can focus on your goals and happiness.

The Investment Committee

Meet the Team

Irvin W. Rosenzweig, CFP®, ChFC®, CLU®, CRPS®, AEP®, AIF® Director

James Witner

Investment Analyst

Adam Bailey

Investment Operations Analyst

The Investment Committee at Diversified brings a vast collection of experience and talent.

The committee meets weekly to discuss topics around Diversified’s investment philosophy, strategies, and technology. It’s the responsibility of the Investment Committee to maintain oversight of client portfolios and to proactively make investment recommendations in a rapidly evolving industry.

Diversified’s Investment Philosophy

What We Believe

As an investment committee, we need to have guiding principles and beliefs to shape our decision-making process. These beliefs lay the foundation of how we manage our portfolios and allow us to act in a prudent manner through all economic conditions.

Diversification

Regardless of your risk tolerance, we believe an investor should always be diversified. A diversified approach can involve spreading investments across asset classes (stocks and bonds), geographies (domestic and international), styles (growth and value), and approaches (active and passive). In adopting this philosophy, we believe an investor can create a more efficient portfolio and a long-term investment strategy designed to weather various economic conditions.

Financial Planning Comes First

An investment plan starts with a financial plan. Understanding an investor’s risk tolerance, including their ability and willingness to take risk, is paramount to setting appropriate goals and expectations. An investment plan should be designed to achieve one’s financial and personal goals. Investors who are accumulating versus those who are decumulating need to be handled differently.

Market Timing Doesn’t Work

Selling at a market top and buying in at the bottom requires being correct twice. Now do that over and over again. Market timing is extremely difficult and we believe no one can do it successfully over the long-term. We believe in a long-term investment approach with active portfolio management.

Tactical Asset Allocation Can Exploit Inefficiencies

Being long-term investors doesn’t mean never making portfolio changes. We prefer utilizing shifts in economic conditions and overreactions by market participants to tactically shift portfolios to areas where we see opportunity. These changes can be within our investment selection or allocations to different investment styles, sectors, sizes, and geographic regions.

Investment Selection Can Add Value

Active versus passive. Mutual fund versus exchange traded fund (ETF). The decision process on how to implement your portfolio should be thoughtful and purposeful. We believe in using both active and passive investments, along with mutual funds and ETFs. The art is in where you use each and the process that is used to select investments. There are over 16,000 investment companies as of 2020 (according to the Investment Company Institute), so there needs to be a robust process in making those selections.

Minimizing Taxes

Raise your hand if you like paying taxes. We can only assume everyone’s hands are down. When managing taxable accounts, it’s not what you make but rather what you keep. Taxable investments (non-IRAs and non-qualified plans) can generate taxes annually so there should be a process in place to manage taxes based on your individual situation. We look to utilize strategies such as asset location, tax loss harvesting, tax-free fixed income, and wider rebalancing thresholds as part of our tax management process.

Controlling Investors’ Emotions Matters

One of our most important jobs is behavioral coaching. Annual studies show that the vast majority of investor under-performance is due to poor behavior. This can be selling when markets fall, chasing the best performing investment from last year, or jumping into a stock tip from your neighbor. We all have behavioral biases and whether or not we’re successful in reaching our financial goals often comes down to how we control that behavior.

Investors Appreciate Education, Communication, and Transparency

We’ve found that frequent education and communication builds better, long-lasting, and trusting relationships. We spend a significant amount of time putting out communications (both written and video) on current market events and portfolio positioning. We take a lot of pride in the trust our clients put in us, so in return we want to be as transparent as possible.

Diversified’s Investment Process

Learn how we handle your investments during our Lifelong partnership

-

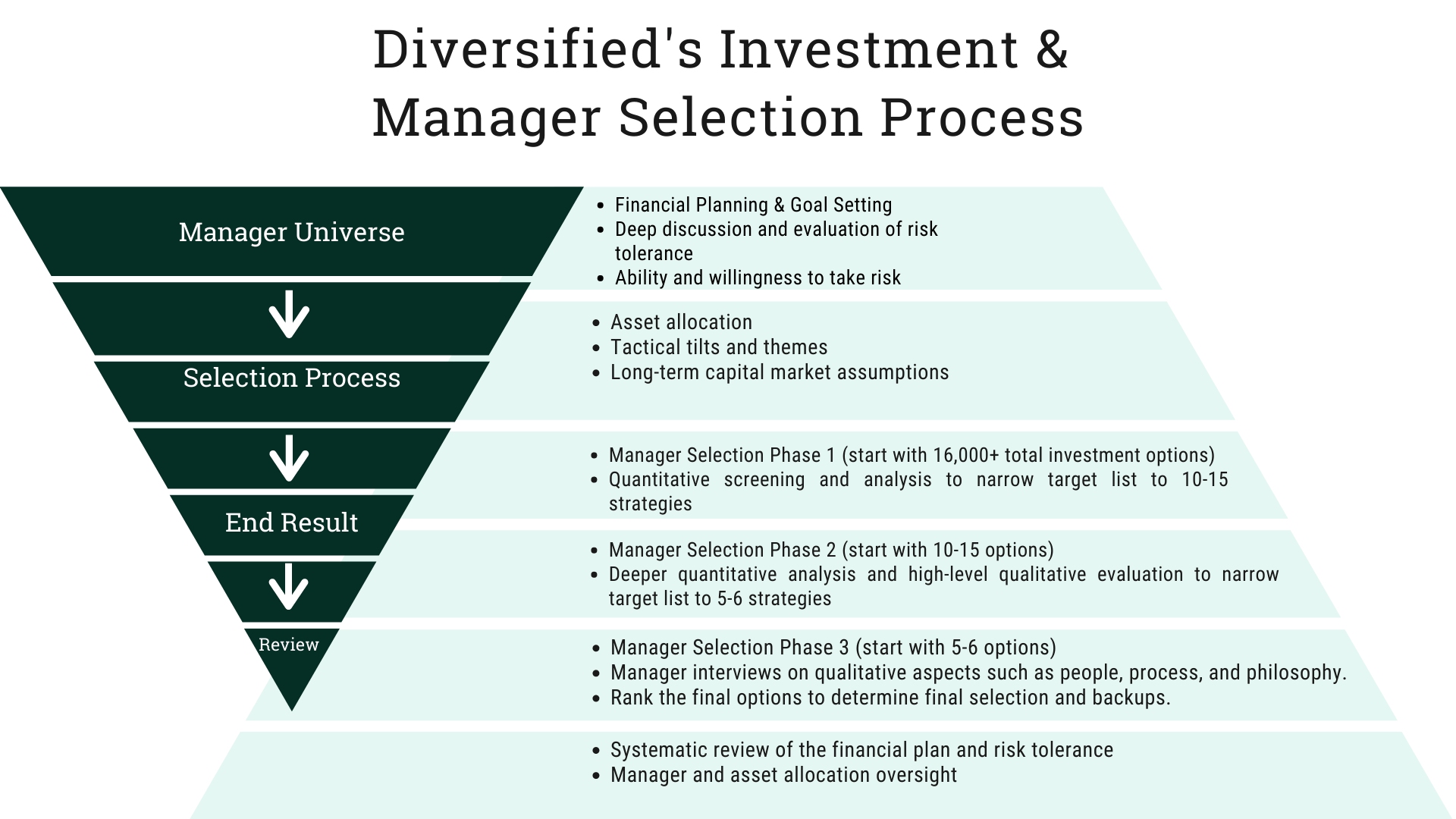

Planning

Our relationship begins with the planning process. You and your financial advisor collaborate on your financial and personal goals, and build a plan to achieve them. As part of this plan, we get a deeper understanding of your risk tolerance, which includes your ability (quantitative) and willingness (qualitative) to take risk. A thorough understanding of both your goals and risk tolerance should be the building block of your investment portfolio.

-

Tactical Asset Allocation

Some investors buy and hold their investments for a very long time while others are in and out of the markets, attempting to time the ups and downs. Our process sits in the middle of these polar opposite philosophies. We create an asset allocation framework that will allow for long-term diversified returns but also be flexible in the short-term to take advantage of dislocations and opportunities that we see in markets. These adjustments can take place within both equity and fixed income portfolios.

-

Investment Selection

Once we have the targeted asset allocation, we go through the daunting task of filtering down from over 16,000 investment companies (mutual funds, ETFs, UITs, and closed-end funds). Investors who do this on their own are tasked with deciding whether to use active strategies, or passive index funds. They also must decide whether to use individual stocks, mutual funds, or exchange traded funds (ETFs).

As part of this process, the Investment Committee goes through a 3-Phase process to screen down and ultimately select the strategies within our portfolios. From start to finish, this process typically takes anywhere from 1-3 months. The first part of the process is more quantitative, focusing on screening out undesired strategies that don’t meet minimum requirements across several criteria. Some examples of these criteria are risk-adjusted return, information ratio, expense ratio, manager tenure, assets in strategy, and up/down capture ratios. During this first phase, we target a final list of 10-15 strategies.

In the second phase, we internally take a deeper dive into the quantitative information for each strategy and some qualitative aspects. Some things we’re reviewing in this phase are underlying portfolio holdings, stated objectives, risk-adjusted returns across several time periods, and factor evaluation. By focusing on a smaller set of names, we can narrow our focus list to 5-6 strategies to make the final cut.

The final phase is more qualitative in nature. We speak with a portfolio manager or specialist from each team we’re considering. Our goal is to learn about the things the numbers won’t tell us, such as the people, process, and philosophy behind the strategy. This is the most important step, in our view, as its imperative that we’re completely comfortable with the team and their decision-making process. This final phase will give us our final decision.

-

Continuous Monitoring & Oversight

Once the underlying allocations and investments are selected, our job is only just beginning. We must maintain constant oversight on both economic conditions and our underlying strategies. Our Investment Committee meets weekly to discuss both and those discussions often lead to eventual strategy changes. As economic conditions and market valuations change, we consider changes to our underlying asset allocation. Over time, we evaluate the performance and risk of all managers, and if persistent underperformance occurs or if a key personnel leaves, we put the strategy under review and restart our selection process. This process finishes where it started, back at the financial planning process. You and your financial advisor will continue to work to ensure the portfolio still aligns with your risk tolerance and ultimately your long-term goals.

Diversified’s Investment & Manager Selection Process

More From The Investment Committee

Recent Investment Posts

- Equities Rise as Central Banks Hike Rates Again

- Equities Rise Headlined by Economic Growth and Easing Inflation

- Equities Fall Amid Mixed Economic Data

- Equities Start Positive to Begin 2023

- Equities End 2022 on a Negative Note

Market Update Videos

- September Market Insight Video: The Labor Market Conundrum

- August Market Insight Video: Has Inflation Peaked?

- Diversified’s March 2021 Market Update and Quarter in Review

- Diversified’s March 2021 Market Update and Quarter in Review

- Diversified’s January 2021 Market Update and Quarter in Review

The Diversified Difference

Contact UsAre you ready for Lifelong Wealth?

Contact us today for a consultation.