Equities Fall and Yields Surge on Inflation and Growth Releases

Equities Fall and Yields Surge on Inflation and Growth Releases

Equity markets fell last week as markets reacted to another hotter-than-expected inflation report and cautionary sales outlooks from retailers. Global equities (represented by the MSCI All Country World Index) were down -2.61%, and domestic stocks (represented by the S&P 500 Index) were down -2.66%.

Personal Consumption Expenditures Index

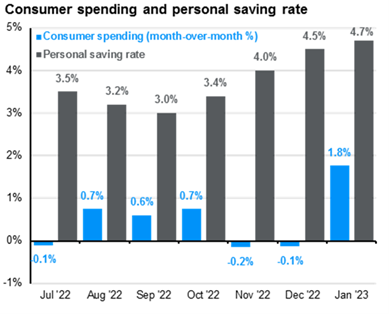

The core (excludes food and energy) Personal Consumption Expenditures (PCE) price index rose 0.6% in January which was higher than the expected 0.4% and the largest monthly increase since August. On a year-over-year basis, the core PCE price index also surprised on the upside rising 4.7% while expectations were for a drop to 4.3%. Within the report, US Personal Spending jumped 1.8% for the month, the highest increase since March 2021.

Earnings Reports

As the fourth quarter 2022 earnings season is wrapping up, many US retailers have expressed caution about sales growth for 2023. Home Depot reported earnings last week in which they missed consensus estimates on revenue for the first time since November 2019. Revenue growth from a year prior rose 0.3%, but they forecasted for the new fiscal year sales to remain flat due to economic pressures on goods and consumer spending.

FOMC Minutes

FOMC meeting minutes from their February meeting were released last Wednesday which showed Fed officials expecting more rate hikes to be necessary to bring down inflation. The growth and inflation data brought on more worries of further rate hikes by the Fed which led to a surge in Treasury yields. The 10-year Treasury yield almost reached 4.00% last week, a level it hasn’t been above since November. The 2-year Treasury yield also climbed to 4.78%, remaining inverted against the longer 10-year rate. Markets currently expect rate increases of 0.25% by the Fed in March, May, and June.

Coming Up

This week’s economic calendar includes the ISM Manufacturing index which has been a strong coincident indicator of bottoming near the same time as equity markets. The index is in a contractionary environment and has fallen for the past 5 straight months. Pending home sales, home prices, and consumer confidence are also slated to be released this week as well.

I’d like to leave you with the final line we’ve used since we started these commentaries back at the very height of market volatility in March 2020. Always remember that we create financial/investment plans not for the easy times, but to prepare for the tough ones.