Global Stocks Choppy as the Ukrainian Crisis Continues

Ukrainian Crisis Continues

Markets continued to bounce around last week as Russia’s invasion of Ukraine intensified. We saw global markets (represented by the MSCI All Country World Index) down -2.7% and domestic stocks (represented by the S&P 500 Index) down -1.2%. It was developed international markets hit hardest, led obviously by Europe. The developed international index, the MSCI EAFE Index, was down -6.5% last week.

Economic Sanctions

The pressure on stocks globally was clearly centered on the crisis in eastern Europe. As Russia continues its invasion of Ukraine, western economic powers have hit Russia with several crushing economic sanctions. First, several Russian lenders have been excluded from the SWIFT network. Second, many Russian oligarchs tied to President Putin are facing penalties and asset repossession. As the world distances itself from Russia, the ruble has fallen to all-time lows against the US dollar.

The Price of Oil

One of the primary economic focuses has been on the price of oil given Russia’s place in world production. At points over the weekend, the price per barrel has risen near $130 per barrel. It has since come back to under $120 per barrel.

February Labor Report

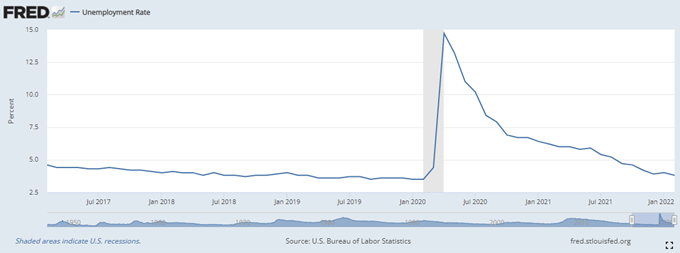

The February labor report released last week was overshadowed by the events in Europe. For those who missed it, the U.S. economy added 678,000 jobs in February and the unemployment rate domestically is down to 3.8%. That is the lowest level since the pandemic began.

Earnings Growth

As Q4 2021 earnings reports come to an end, FactSet has reported that the year-over-year earnings growth for Q4 2021 should land just above 30%. That is the fourth consecutive quarter of 30% or more earnings growth. The attention now turns to expectations for Q1 2022 as earnings growth will slow relative to last year. Our expectations are for continued strong earnings, the strength of which will be driven by economic impacts of both geopolitics and inflationary pressures.

Unemployment Levels

As unemployment continues to improve, you can see graphicly below that we’re getting back to pre-pandemic levels. This chart shows the unemployment rate in the U.S. over the last five years.

I’d like to leave you with the final line we’ve used since we started these commentaries back at the very height of market volatility in March 2020. Always remember that we create financial/investment plans not for the easy times, but to prepare for the tough ones.