Equities Rise Prior to FOMC Meeting

Equities Rise Prior to FOMC Meeting

Equity markets rose for the second week in a row with global equities (represented by the MSCI All Country World Index) up 3.35% and domestic stocks (represented by the S&P 500 Index) up 3.97%. Through Friday, October has been a strong month for markets with global and domestic equities up 6.49% and 8.90% respectively with one trading day left.

GDP Estimates

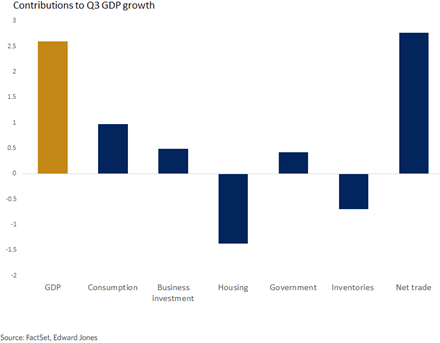

The first estimate of Q3 US GDP was released last week showing growth of 2.6% on an annualized basis which beat estimates of 2.4%. This is the first positive reading of 2022 with strong net trade and resilient consumer spending helping to offset a decline in residential investment.

Corporate Earnings

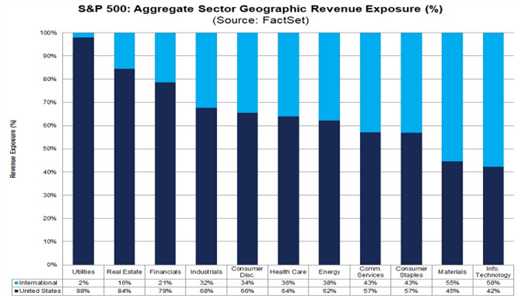

Over 50% of S&P 500 companies have now reported Q3 earnings with large tech and communication services companies such as Apple, Microsoft, Meta, and Alphabet reporting last week. While 71% of companies have had a positive earnings beat, the expected blended earnings growth rate of 2.2% would be the lowest for a quarter since the third quarter of 2020. The strength of the US Dollar has weighed on earnings of companies that produce a significant portion of revenue from other geographical regions with the technology sector having the largest revenue from international countries as seen below. Resilient consumer spending has helped companies weather higher input prices, especially in areas with pent-up demand like travel and leisure.

Personal Consumption Expenditures Index

The Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, rose 0.3% month-over-month and 6.2% year-over-year for September which was in-line with August’s reading. However, the core PCE reading (excluding volatile food and energy) increased by 5.1% on an annual basis, slightly lower than the 5.2% expectation. The US Fed holds their two-day policy meeting this week with markets expecting a fourth straight 0.75% hike to its benchmark Federal Funds rate. The current range is 3.00-3.25%, and the target rate entered the year at a range of 0.00-0.25%.

Labor Market Update

This week also brings the monthly labor market update which has been a sign of economic strength with the unemployment rate at 3.5% in August and continued job growth. The Institute for Supply Management is also due to release its monthly Purchasing Managers Index (PMI) related to the manufacturing sector’s economic activity. The index has remained in expansionary territory through last month but has moderated since the beginning of the year.

I’d like to leave you with the final line we’ve used since we started these commentaries back at the very height of market volatility in March 2020. Always remember that we create financial/investment plans not for the easy times, but to prepare for the tough ones.

Regards,